The General Ford Motors Corporation (GFMC) is planning the introduction of a brand new SUV—the Vector. There are two options for production. One is to build the Vector at the company’s existing plant in Indiana, sharing production time with its line of minivans that are currently being produced there. If sales of the Vector are just moderate, this will work out well as there is sufficient capacity to produce both types of vehicles at the same plant. However, if sales of the Vector are strong, this option would require the operation of a third shift, which would lead to significantly higher costs.

A second option is to open a new plant in Georgia. This plant would have sufficient capacity to meet even the largest projections for sales of the Vector. However, if sales are only moderate, the plant would be underutilized and therefore less efficient.

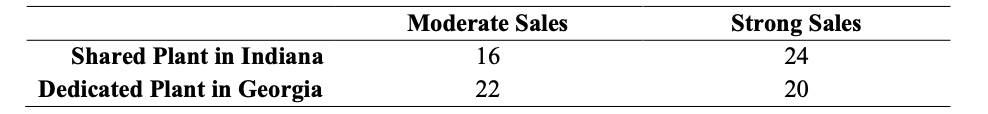

This is a new design, so sales are hard to predict. However, GFMC predicts that there would be about a 55% chance of strong sales (annual sales of 100,000), and a 45% chance of moderate sales (annual sales of 50,000). The average revenue per Vector sold is $30,000. Production costs per vehicle for the two production options depend upon sales, as indicated in the table below.

The amortized annual cost of plant construction and other associated fixed costs for the Georgia plant would total $400 million per year (regardless of sales volume). The fixed costs for adding Vector production to the plant in Indiana would total $200 million per year (regardless of sales volume).

a. Construct a decision tree to determine which production option maximizes the expected annual profit, considering fixed costs, production costs, and sales revenues.

b. Due to the uncertainty in expected sales for the Vector, GFMC is considering conducting a marketing survey to determine customer attitudes toward the Vector and better predict the likelihood of strong sales. The marketing survey would give one of two results—a positive attitude or a negative attitude toward the design. GFMC has used this marketing survey for other vehicles. For vehicles that eventually had strong sales, the marketing survey indicated positive attitudes toward the design 70% of the time and negative attitudes 30% of the time. For vehicles that eventually had moderate sales, the marketing survey indicated positive attitudes toward the design 20% of the time and negative attitudes 80% of the time. Assuming GFMC conducts such a survey, construct a decision tree to to determine how the company should

proceed and what the expected annual profit would be (ignoring the cost of the survey).

c. What is the expected value of the sample information in part b? What does this say

about how large the cost of the marketing survey can be before it would no longer be worthwhile to conduct the survey?